The Pulse of News

Stay updated with the latest trends and insights.

Term Life Insurance: Guarding Your Future with a Safety Net

Discover how term life insurance can secure your family's future and provide peace of mind. Protect what matters most today!

Understanding Term Life Insurance: Key Benefits and Features

Understanding term life insurance is essential for anyone looking to secure financial protection for their loved ones. Unlike whole life insurance, which provides coverage for the entire life of the insured, term life insurance is designed to offer coverage for a specific period, usually ranging from 10 to 30 years. This makes it a more affordable option for families needing substantial coverage during critical years, such as raising children or paying off a mortgage. By choosing a policy with the right term length, policyholders can ensure that their beneficiaries are protected in the event of an untimely death.

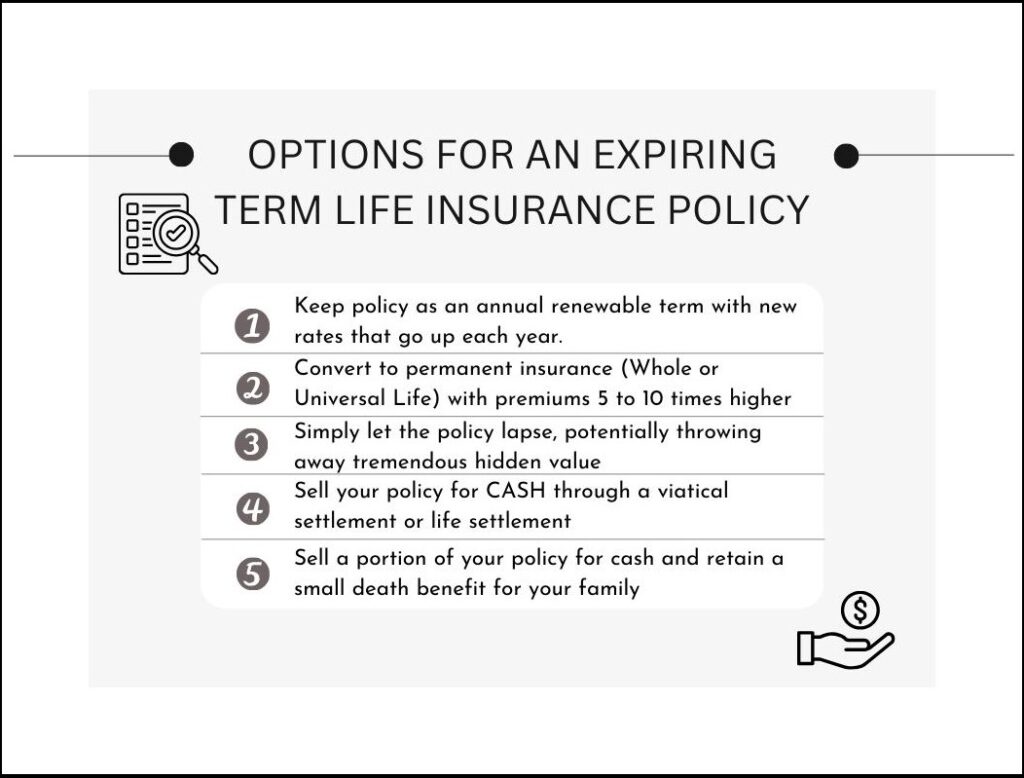

The key benefits of term life insurance include lower premiums compared to permanent life insurance, flexibility in coverage amounts, and the option to convert to a whole life policy in the future. Additionally, many policies offer a renewable feature, allowing individuals to extend their coverage at the end of the term without undergoing a medical exam. Here are some of the essential features:

- Affordability: Provides high coverage for lower monthly payments.

- Customizable terms: Choose coverage that suits your financial needs.

- Simple payout: Beneficiaries receive a lump sum in the event of the policyholder's death.

Is Term Life Insurance Right for You? Common Questions Answered

Term life insurance is a popular choice for many individuals and families seeking financial security. It provides coverage for a specified period, typically ranging from 10 to 30 years, offering peace of mind during critical life stages such as raising children or paying off a mortgage. One common question is, 'How much coverage do I really need?' A general rule of thumb is to multiply your annual income by 10 to determine a suitable coverage amount, but personal circumstances—like debts, education costs for children, and living expenses—should also be considered.

Another frequent inquiry is about the affordability of term life insurance. The cost can vary based on several factors including age, health, and lifestyle. However, many find it to be a more economical option than permanent life insurance, making it an attractive choice for those on a budget. If you are still unsure, consider asking yourself these questions:

- Will my financial obligations change in the next decade?

- Do I need coverage only until my children are grown?

- What are my long-term financial goals?

How to Choose the Best Term Life Insurance Policy for Your Needs

Choosing the best term life insurance policy for your needs involves evaluating several key factors to ensure that you receive the right coverage. Start by assessing your financial obligations, such as outstanding debts, mortgage payments, and your dependents' future needs. This will help you determine the amount of coverage required. Additionally, consider the policy's duration; term life insurance typically comes in 10, 20, or 30-year terms, so choose one that aligns with your long-term goals and personal situation.

Next, compare quotes from various insurance providers to find a policy that fits both your budget and coverage requirements. Pay attention to the policy features, such as convertibility options, which allow you to switch to a permanent policy later without undergoing a medical exam. To make an informed decision, read customer reviews and consult with a financial advisor if necessary. Remember, the ideal term life insurance policy is one that provides peace of mind while protecting your loved ones' financial future.