The Pulse of News

Stay updated with the latest trends and insights.

Insure or Endure: The Pet Owner's Dilemma

Discover the surprising truth behind pet insurance! Will you insure your furry friend or risk it all? Don’t miss this vital guide!

Understanding Pet Insurance: Is It Worth the Cost?

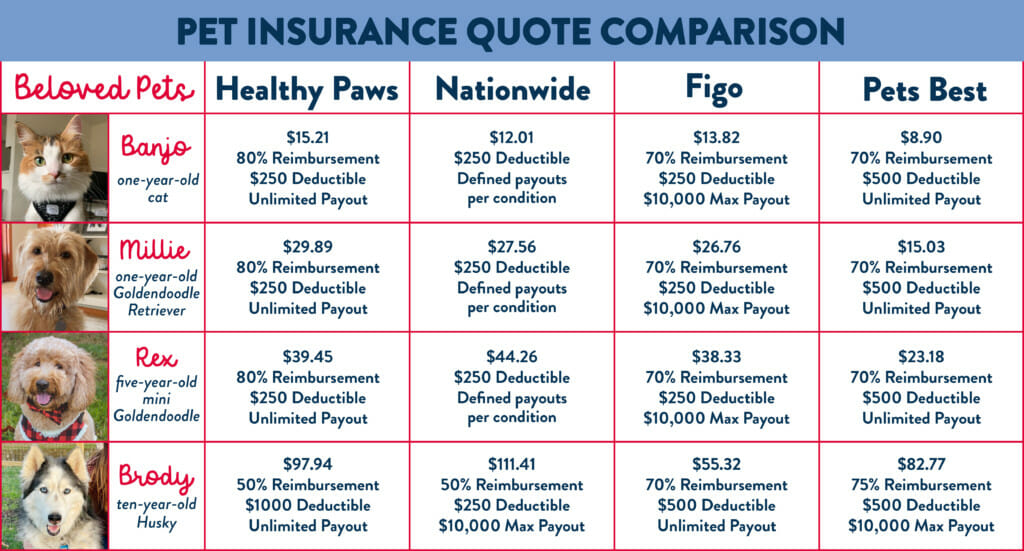

Pet insurance has become an increasingly popular option for pet owners looking to safeguard their furry friends against unexpected medical expenses. Understanding pet insurance involves knowing how it works, the types of coverage available, and the potential costs involved. Many plans cover accidents, illnesses, and even routine care, but the specifics can vary widely among providers. Before enrolling in a policy, it’s essential to evaluate your pet’s needs and any pre-existing conditions they may have, as these factors can significantly affect coverage options and premiums.

When considering if pet insurance is worth the cost, it's important to weigh the financial impact of pet healthcare against the monthly premiums. A study estimates that the average pet owner can spend between $500 to over $2,000 annually on veterinary care, depending on the pet's age and health. For pet parents with limited savings, a comprehensive insurance plan can alleviate stress during emergencies and can even lead to significant savings in the long run. Ultimately, deciding whether to invest in pet insurance depends on individual circumstances, but for many, the peace of mind it offers is invaluable.

Top 5 Reasons Pet Owners Choose to Self-Insure

For many pet owners, self-insuring their furry friends has become an increasingly popular choice. One significant reason is the cost-effectiveness it offers. Monthly premiums for pet insurance can quickly add up, leading to substantial yearly expenses. By choosing to self-insure, owners can allocate funds in a dedicated savings account specifically for their pet's medical needs. This approach not only allows for better financial management but also provides peace of mind as owners know exactly where their money is going.

Another reason pet owners opt for self-insuring is the increased flexibility it offers. With traditional pet insurance, policyholders must adhere to specific coverage limits and may face restrictions on the types of treatments covered. In contrast, self-insured individuals maintain full control over their pet's healthcare decisions, enabling them to choose the best veterinary options without worrying about policy exclusions. This freedom allows pet owners to prioritize their pet's well-being without financial constraints.

How to Decide: Should You Insure Your Pet or Take the Risk?

Deciding whether to insure your pet or take the risk can be a challenging choice for many pet owners. The primary factor to consider is the potential costs associated with unforeseen veterinary expenses. With the rising cost of pet care, a single accident or illness can lead to substantial bills. By opting for pet insurance, you can mitigate these costs, making it easier to manage your finances should your furry friend require emergency medical attention. Additionally, consider your pet's breed and age, as certain breeds are prone to specific health issues that could lead to higher medical expenses over their lifetime.

On the other hand, some pet owners might feel confident that they can cover the costs as they arise and prefer not to deal with insurance premiums. If you have a healthy pet and a solid emergency savings plan, taking the risk might be a feasible option. It’s essential to weigh your financial stability against the unpredictability of pet health. Create a list of pros and cons based on your individual situation, and remember that your choice should align with your comfort level regarding risk and financial preparedness.