The Pulse of News

Stay updated with the latest trends and insights.

Why Your Landlord’s Insurance Isn’t Enough to Keep You Safe

Discover why relying solely on your landlord's insurance could leave you vulnerable. Learn essential tips to protect yourself today!

Understanding the Limitations of Your Landlord's Insurance Policy

Understanding the limitations of your landlord's insurance policy is crucial for protecting your investment and ensuring financial stability. Many landlords assume that their policy covers all potential issues, only to find out later that certain damages or losses are excluded. For instance, standard landlord insurance typically covers property damage, liability claims, and loss of rental income; however, it may not extend to tenant-caused damage, maintenance-related issues, or natural disasters like floods or earthquakes. Therefore, it is essential to closely review your policy and identify any gaps in coverage that could leave you vulnerable in a crisis.

Additionally, landlords should be aware of the liability limitations that may exist within their insurance policies. For example, if a tenant is injured on your property due to negligence, your policy might not cover legal fees or settlements if the injury falls outside your coverage limits. This can lead to significant out-of-pocket expenses and potentially jeopardize your finances. To safeguard against unexpected liabilities, consider increasing your policy limits or adding an umbrella insurance policy for enhanced protection. By understanding these crucial aspects of your landlord's insurance policy, you can make informed decisions that bolster your financial security.

Is Your Safety Covered? Common Gaps in Landlord Insurance

Many landlords believe that their insurance policy offers comprehensive protection, yet common gaps can leave them vulnerable. First and foremost, loss of rent coverage is often overlooked. In cases where a tenant fails to pay rent, landlords may find themselves financially strained. Additionally, standard policies might not cover certain types of natural disasters, resulting in significant out-of-pocket expenses. It's crucial for landlords to conduct a thorough review of their policy and assess any coverage exclusions that may apply, ensuring that their investment is adequately protected.

Another common gap found in landlord insurance is the lack of liability coverage for accidents occurring on the rental property. If a tenant or visitor gets injured due to maintenance issues like faulty wiring or a broken staircase, the landlord may be held financially responsible. Furthermore, while some policies cover damages caused by tenants, they may not account for intentional damage or neglect. To ensure complete safety and security, landlords should consider adding additional endorsements or riders to their policies, tailoring coverage to the specific risks associated with their rental properties.

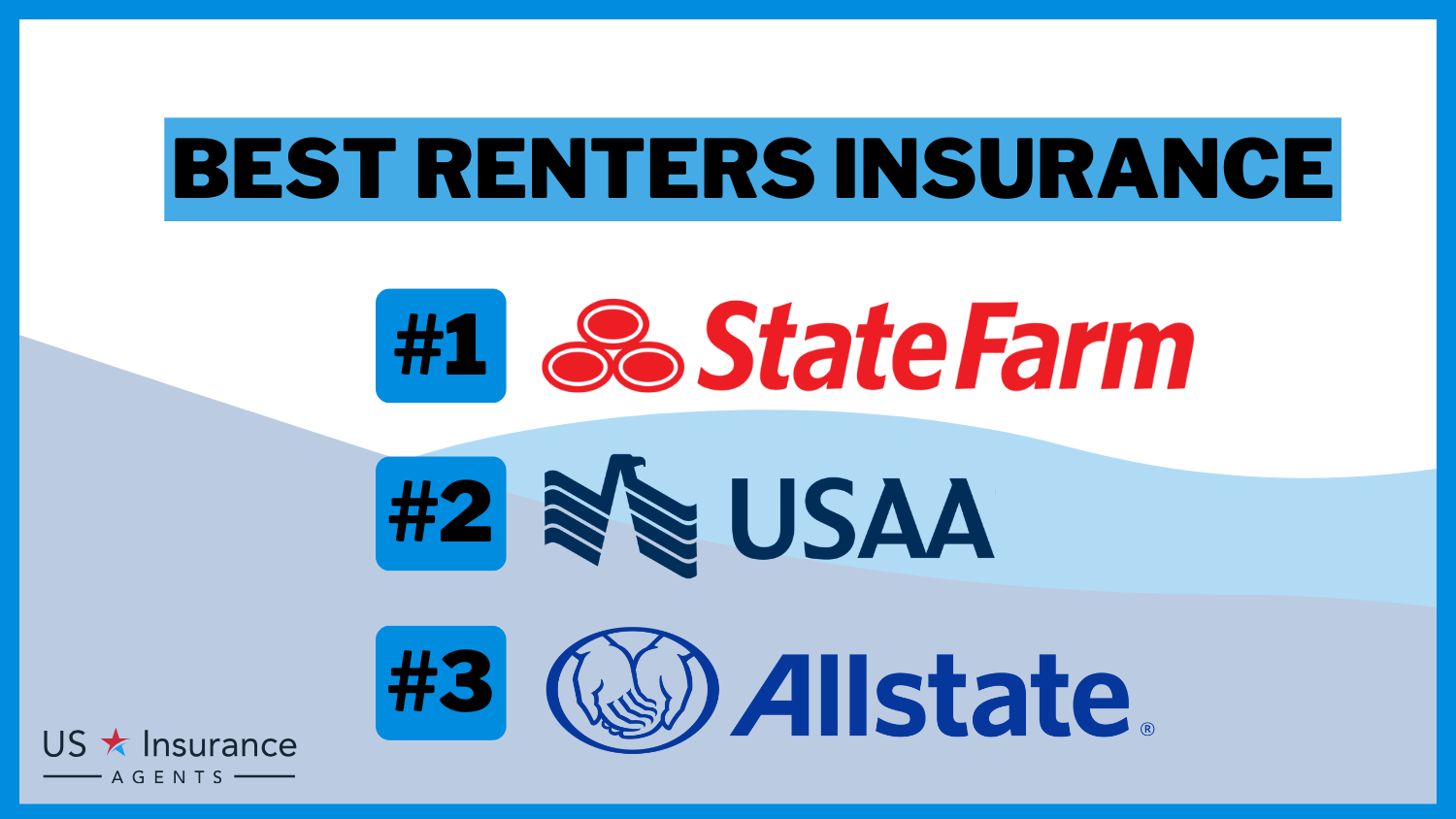

What You Need to Know About Tenant Insurance vs. Landlord Coverage

Tenant insurance and landlord coverage are essential components of the rental ecosystem, each serving distinct purposes. Tenant insurance, or renter's insurance, primarily protects the tenant's personal belongings in case of theft, fire, or other damages. It not only covers the costs of replacing lost items but also provides liability coverage in case someone is injured within the rented property. On the other hand, landlord coverage is designed to protect the property owner against damages to the physical structure and liability associated with the property itself, ensuring that any repairs or legal costs are covered should accidents occur.

When considering whether to invest in tenant insurance or rely solely on landlord coverage, it's important to recognize the specific needs and risks involved. Tenant insurance is typically affordable and can save renters from devastating financial losses, especially in a crisis. Conversely, while landlord coverage protects the building and common areas, it does not extend to personal items belonging to tenants. Therefore, renters should strongly consider obtaining their own coverage to safeguard their belongings, making both types of insurance crucial in ensuring comprehensive protection for all parties involved in the rental arrangement.