The Pulse of News

Stay updated with the latest trends and insights.

Discount Diving: How to Sink Your Auto Insurance Costs

Dive into savings! Discover top tips to slash your auto insurance costs and keep your wallet afloat. Don't miss out!

5 Proven Strategies to Slash Your Auto Insurance Premiums

If you're looking to slash your auto insurance premiums, implementing effective strategies can lead to significant savings. Here are five proven strategies that can help reduce your monthly costs:

- Shop Around: Different insurance companies offer varying rates, so it's crucial to compare quotes from multiple insurers. You might find that switching providers can save you hundreds of dollars annually.

- Increase Your Deductible: Opting for a higher deductible means you'll pay more out of pocket in the event of a claim, but it can significantly lower your premium. Evaluate your financial situation to determine a deductible level that works for you.

In addition to the initial steps, consider incorporating these further strategies into your plan to lower your auto insurance premiums even more:

- Utilize Discounts: Many insurers offer discounts for safe driving, bundling policies, or having certain safety features in your vehicle. Always ask about available discounts that could apply to you.

- Maintain a Good Credit Score: Insurers often assess credit history when determining your premium. Taking steps to improve your credit score can lead to lower rates.

- Limit Mileage: Reducing the number of miles you drive annually can lower your risk profile, which may result in a discount. Consider carpooling or using public transportation when possible.

What Discounts Are Available for Auto Insurance and How to Qualify?

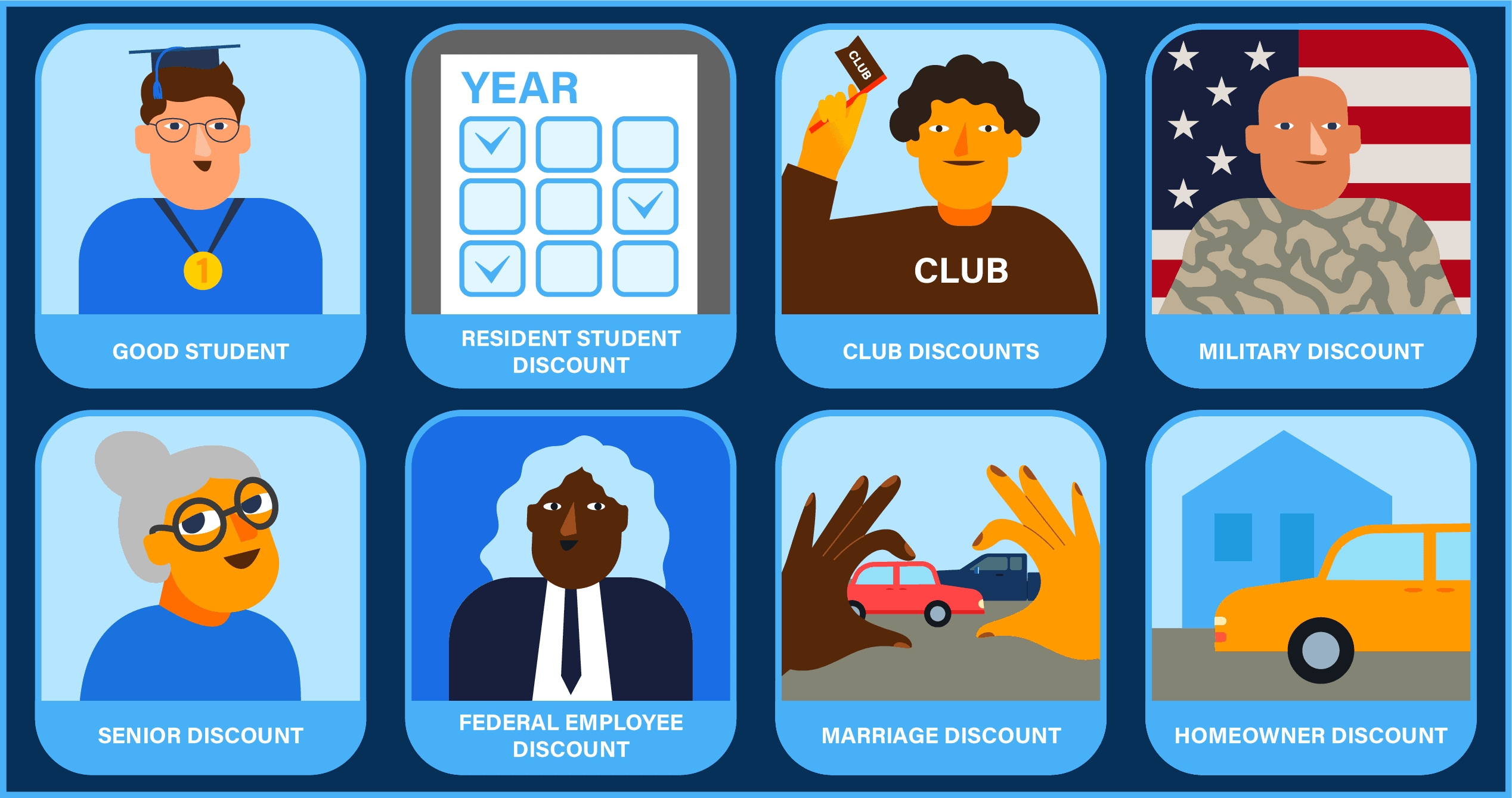

When it comes to auto insurance, there are several discounts available that can help lower your premium costs. Common types of discounts include:

- Safe Driver Discounts: awarded to drivers with a clean driving record.

- Multi-Policy Discounts: for bundling auto insurance with other types of insurance.

- Good Student Discounts: for young drivers who maintain a high GPA.

- Low Mileage Discounts: for those who drive less than a certain number of miles per year.

Qualifying for these auto insurance discounts often requires specific actions or documentation. For instance, to obtain a safe driver discount, you typically need to provide proof of your driving history. Similarly, to benefit from a multi-policy discount, you must show evidence of holding another policy with the same insurer. It’s also worthwhile to regularly review your policy, as many insurers offer seasonal or loyalty discounts that you may be eligible for. Always inquire with your insurance provider about any available discounts to ensure you're not missing out on potential savings.

The Ultimate Guide to Comparing Auto Insurance Rates: Save Big on Your Policy

Finding the best auto insurance rates can feel overwhelming, but with the right approach, you can save big on your policy. Start by gathering quotes from multiple insurance providers to get a comprehensive view of the market. Consider factors such as coverage options, deductibles, and the insurer's reputation for customer service. Here are some essential steps to guide you:

- Determine the coverage you need based on your vehicle and personal circumstances.

- Collect quotes from at least three to five different insurers.

- Compare not just the prices, but also the features and benefits of each policy.

Once you've gathered your quotes, it's crucial to dive deeper into the details. Many people overlook discounts that could significantly lower their premiums. Common discounts include safe driver discounts, multi-policy discounts, and savings for having features like anti-theft devices. Evaluating the varying rates while keeping an eye on these potential discounts can lead to remarkable savings. Remember to also review each policy's terms carefully to avoid any unexpected coverage gaps.